Artificial Intelligence, Financial Services

Artificial Intelligence in the Financial Sector – Between Efficiency and Risk Management

Big data and the integration of AI are transforming financial markets. Banks generate huge amounts of data every day from communications, transactions, and customer interactions. This data contains valuable information, but traditional auditing and analysis methods are struggling to cope with the growing complexity.

The adoption of AI opens up enormous potential for the financial services industry. Institutions that use automation and machine learning to handle routine processes, improve the quality of advice and analyze large amounts of data gain competitive advantages and accelerate digital transformation. This creates sustainable improvements in risk management and overall efficiency.

With increasing expectations from regulators such as BaFin, the FCA and the SEC, the careful use of AI can support banks in demonstrating financial compliance more consistently. Complete documentation, audit-proof records and transparent evidence are becoming essential. At the same time, intelligent compliance depends on AI-driven solutions that are both secure and trustworthy. A company in the financial sector needs systems that handle customer data responsibly, and where AI can help financial institutions apply methods such as natural language processing to generate more reliable insights. This builds long-term confidence with regulators and clients. Institutions that want to benefit from innovative AI solutions should also be prepared to address challenges such as bias, explainability and operational uncertainties.

This article shows how financial institutions can optimize their processes with generative AI. AI monitoring and real-time compliance achieve regulatory transparency, what opportunities exist for process optimization and customer experience through AI in customer service, and how Recording Insights is driving digital transformation in the banking sector with specialized technology using AI Policy Templates.

AI for Compliance Monitoring – Reduce Exposure and Improve Oversight

Regulatory authorities are cracking down harder: In 2024, the US SEC imposed fines totaling $8.2 billion, while in Germany, BaFin also imposed fines amounting to millions.

Common reasons include missing or incomplete records and off-channel communication via private messengers in financial services.

Manual monitoring quickly reaches its limits in the banking environment. Typically, only 1 to 2 percent of communications are reviewed, while the majority remain unchecked. This is precisely where risks can arise: problematic behavior, incorrect advice, or off-channel communication can be overlooked until the supervisory authority intervenes.

Natural language processing and AgenticAI can significantly expand monitoring capabilities. It is evolving from random checks to more comprehensive analysis. Every customer interaction, such as phone calls, chats, or video conferences, can be automatically recorded and evaluated. AI helps with fraud detection, can identify inappropriate advice, flag anomalies, and provide compliance teams with clues as to where they should take a closer look. This reduces the risk of sanctions because potential violations become visible earlier.

An additional advantage is that generative artificial intelligence can prepare documentation and reports. This provides banks with greater transparency and supports their reporting to regulatory authorities. Rule violations are not automatically prevented, but they can be identified earlier and managed in a more targeted manner.

Increased Efficiency Through AI – From Random Sampling to Automation

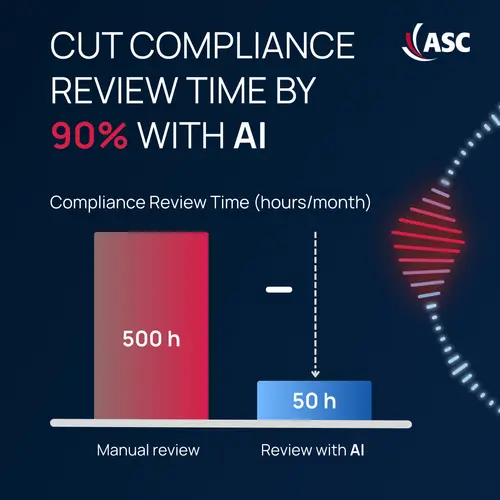

For many banks, compliance monitoring is still associated with heavy manual workloads. With AgenticAI, banks may significantly reduce the effort involved in compliance monitoring. The system analyzes all conversations and highlights passages where anomalies may exist. Those responsible no longer have to review every conversation in its entirety, but can jump directly to the relevant sections. The enormous increase in efficiency within the company is evident in the massive time savings.

With 1,000 conversations per month, the effort required for manual review is reduced from around 500 hours to around 50 hours. In practice, this means savings of up to 90 percent of review time. Compliance teams are relieved of some of their workload and can use their time more effectively, while at the same time achieving almost complete coverage.

This also represents progress for customer service. Instead of random samples, all interactions are included in the analysis, making AI-based feedback and coaching more comprehensive and accurate. Customer feedback and coaching are no longer based on random samples, but on complete data. This increases the quality and accuracy of the advice provided.

One Archive, One Set of Rules – Single Pane of Glass for Communication

The financial services industry is moving away from fragmented system landscapes toward integrated platforms. In the context of ai in finance, the idea of a single pane of glass reflects this shift: a unified interface where all communication channels are centrally recorded, analyzed and archived.

For financial institutions, the integration of AI into compliance workflows means more than technical consolidation. It reshapes the way compliance monitoring and customer service are organized. Instead of navigating scattered data sources and isolated reports, managers gain access to a consistent archive and a single set of rules applied across all interactions. Our policy-based approach with The AI Policy Engine integrated into Recording Insights radically simplifies processes, supports greater automation, and enables checks in near real-time.

The strategic value is clear: Compliance teams can identify issues more quickly and analyze vast amounts of data with higher precision. Advisors benefit from feedback drawn from complete datasets rather than random samples, while decision makers gain a central tool that supports oversight and functions as a form of business intelligence.

ASC translates this principle into practice. Our AI-powered Software Recording Insights combines omnichannel recording, the application of AI Policy Templates for various regulatory frameworks, and a consistent view of all customer communications securly archived in the cloud. This reduces the workload of compliance teams while enabling banks to align regulatory assurance with operational efficiency in a sustainable way.

Security and Governance in Finance – Prerequisites and Framework Conditions for the Use of AI

Modern AI compliance therefore goes beyond technical performance. In the artificial intelligence finance sector, it is important that AI applications are transparent, data is processed securely, and risks such as bias are actively addressed. This is the only way to build trust among regulatory authorities and customers.

ASC relies on a stable foundation here. Our solutions are based on Microsoft Azure AI Services and Azure OpenAI, which are operated according to the strictest European standards. Microsoft follows its own Responsible AI Framework, which defines guidelines for fairness, transparency, data protection, security, inclusion, and accountability. These principles are underpinned by technical controls such as encryption, access restrictions, and continuous audits.

Banks benefit from the fact that the systems are not only powerful but also run on a platform that is designed from the ground up to meet regulatory requirements. This allows them to implement applications that support legally compliant processes and put the provisions of the EU AI Act into practice.

The future of AI in finance will depend on whether it is possible to combine technological innovation with regulatory trust. Banks that design the use of AI on a tested and secure platform not only secure efficiency gains, but also credibility in an industry where trust is crucial.

AI Applications Deliver Real Added Value in the Financial Sector

The added value of AI applications in the financial sector is particularly evident in their ability to help banks make complex regulatory requirements more manageable. Recording Insights provides a range of functions for this purpose.

The AI Policy Templates help translate regulations such as MiFID II, FCA, or Dodd-Frank into specific audit rules. Communication content can be automatically mirrored against these rules, revealing anomalies and creating traceable documentation. This makes it easier to demonstrate compliance with regulatory requirements.

In addition, the integrated AI assistant provides support in day-to-day business. It can create summaries of conversations, provide information on customer satisfaction, or answer questions about conversation content. The Copilot and Recording Insights plugin make work even easier, for example by enabling faster searches for conversations or the ability to prepare content for reports in a compact form.

In this way, the use of AI can help banks make routine tasks more efficient while gaining greater transparency in their processes.

Whitepaper: How Banks Are Overcoming Their Compliance Challenges With AI

AI in the financial sector shows that regulatory security and operational efficiency are not mutually exclusive. With legally compliant and responsible use of AI, communication data can be checked more comprehensively. AgenticAI relieves compliance teams of time-consuming routine tasks and enables faster identification of potential risks.

The future of AI in finance will be shaped by institutions that consider both opportunities and risks. Those who focus on secure and practical implementation today will gain a sustainable advantage in an industry where credibility is crucial.

Download our whitepaper to learn how Recording Insights reduces communication risks and makes compliance more efficient with AI Policy Templates. Or schedule a personal demo to experience the AI-based solution live.