Compliance, Financial Services

Safeguarding consumer rights and interests

In Australia's financial sector, the Internal Dispute Resolution (IDR) framework and regulatory guide 271 (RG 271) are pivotal components in ensuring fair, transparent, and effective handling of consumer and small business complaints.

RG 271, established by the Australian Securities and Investments Commission (ASIC), sets stringent guidelines for financial services to resolve disputes internally. It outlines the obligations of these firms to have an IDR procedure that complies with ASIC's standards, alongside their membership with the Australian Financial Complaints Authority (AFCA).

The development of IDR in Australia reflects the changing needs of the Australian financial services sector. The IDR standards that have emerged from the findings of the Ramsay Review and have been further shaped by amendments to financial legislation, in particular RG 271, reflect the industry's commitment to protecting the rights and interests of consumers.

If customers of a financial services provider have a concern, what does this mean for them?

Johns Use Case

This is John.

He is a retired teacher in Australia and has recently been confronted with a puzzling situation regarding his superannuation.

He noticed two unexpected transactions and contacted his super fund. This marks the start of an experience underpinned by the Internal Dispute Resolution (IDR) framework, a key element in ensuring justice and clarity in the financial sphere.

In-depth data handling: The essence of IDR

The essence of Internal Dispute Resolution (IDR) is to provide a structured and formal process within financial institutions for addressing and resolving complaints made by consumers and small businesses.

It aims to ensure that disputes are resolved in a fair, timely, and efficient manner, reducing the need for external dispute resolution and enhancing customer satisfaction and trust in the financial services sector. Under RG 271, super funds and other financial institutions are required to keep a detailed record of every complaint. This process is not just about keeping records, but also about analyzing each complaint in detail.

It requires:

-

categorization of complaints,

-

monitoring of response times and

-

regular review of complaint handling procedures.

Under the guidelines of RG 271, the Super Fund must respond to complaints relating to superannuation in a maximum of 30 days.

This aims to bolster consumer trust and enforce accountability. However, complying with these comprehensive requirements presents significant challenges for financial institutions. They must adhere to strict timelines, detailed reporting, and enhanced communication standards, all while managing the operational complexities inherent in financial services.

Consequences of non-compliance with Regulatory Guide 271

Non-compliance with RG 271 regulations can result in several consequences for financial institutions in Australia, including regulatory actions by the Australian Securities and Investments Commission (ASIC), potential fines, and reputational damage. Moreover, failure to adhere to these standards may lead to an increased number of disputes being escalated to the Australian Financial Complaints Authority (AFCA), indicating inefficiencies in the internal dispute resolution process and potentially eroding consumer trust and confidence in the financial institution's ability to manage complaints effectively.

Johns Use Case

John's issue with his superannuation transactions is promptly identified as a complaint under RG 271.

This policy defines a complaint as any expression of dissatisfaction addressed to an organization.

The key here is not just in acknowledging a complaint but in recognizing its potential to drive improvement.

How Recording Insights helps with compliance to Regulatory Guide 271

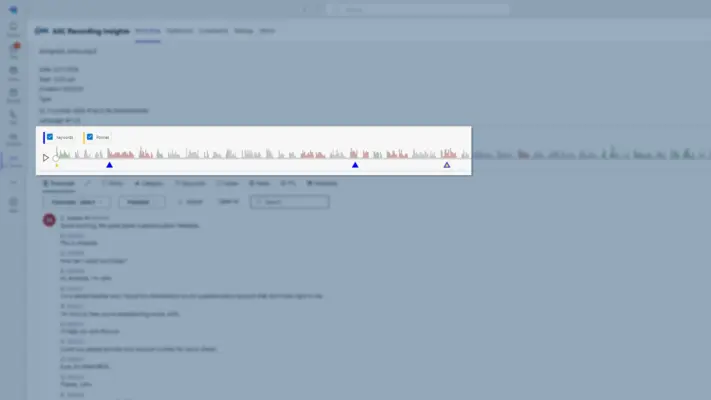

As financial institutions navigate the stringent requirements of RG 271, Recording Insights offers a sophisticated solution to enable compliance. Recording Insights is designed to record and archive communications across various Unified Communications (UC) platforms, including Microsoft Teams, Zoom, RingCentral, or Genesys. It captures all forms of media, such as voice, shared screen, chat, and meeting interactions, facilitating a comprehensive approach to managing and analyzing internal dispute resolutions, thereby aligning with RG 271's mandates for transparent and effective complaint handling processes.

1. Proactive risk identification

RG 271 requirement

RG 271 emphasizes proactive handling and resolution of complaints within specified timeframes.

Solution within Recording Insights

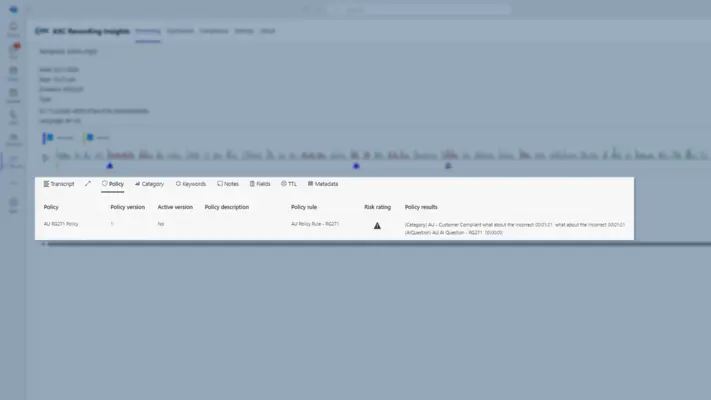

By analysing communication for potential hazards and risks, the AI engine can proactively identify complaints or dissatisfaction in customer interactions, ensuring they are addressed promptly per RG 271 guidelines.

2. Content analysis of recorded communications

RG 271 requirement

RG 271 requires financial institutions to keep records of complaints and the process undertaken to resolve them.

Solution within Recording Insights

The application’s ability to analyse the content of recorded communications can help in categorizing and documenting complaints accurately. For example, in the call between customer and agent, the AI engine could identify key phrases indicating a complaint, ensuring it is logged correctly.

3. Efficiency in handling large volumes of data

RG 271 requirement

Financial institutions likely deal with a high volume of customer interactions, making it challenging to manually review each for compliance.

Solution within Recording Insights

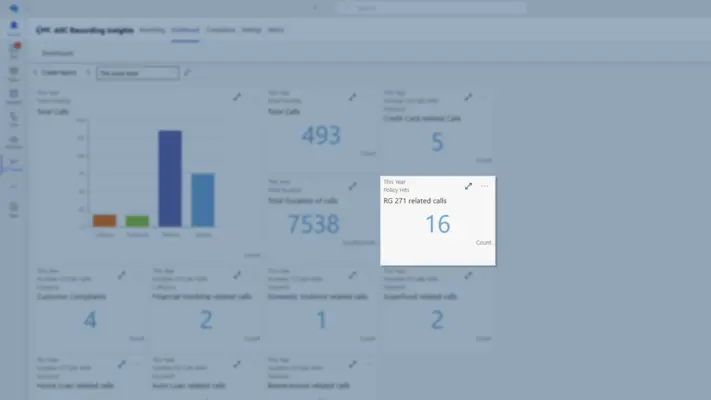

The application’s capacity for handling large datasets can make the process of reviewing customer interactions more efficient. This ensures that all complaints, like John's, are identified and addressed, even in large volumes of data.

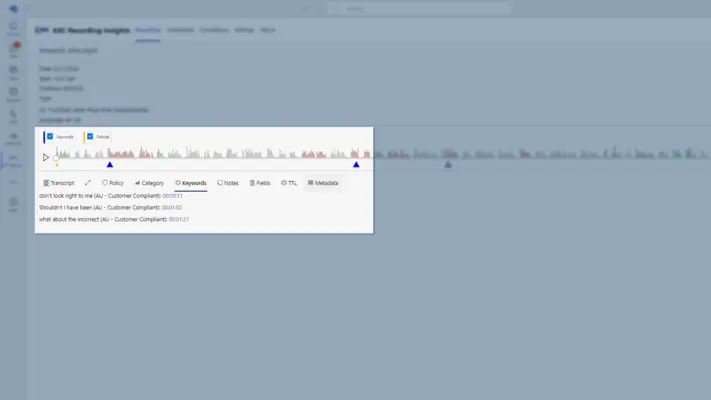

4. Customizable analysis with keywords and patterns

RG 271 Requirement

Different types of complaints might require different handling processes.

Solution within Recording Insights

The ability to customize the analysis with specific keywords, patterns, phrases, and categories means that the engine can be tailored to identify various types of complaints as required under RG 271.

5. Targeted internal investigations

RG 271 Requirement

RG 271 may require targeted investigations in response to specific types of complaints or issues.

Solution within Recording Insights

The dashboard functionality of the application can display analysed conversations for targeted internal investigations, aiding in complying with RG 271’s requirements for thorough and timely complaint resolution.

6. Record keeping and reporting

RG 271 Requirement

Maintaining records of complaints and their resolutions is crucial under RG 271.

Solution within Recording Insights

The engine can assist in systematically logging and categorizing complaints and their responses, ensuring that all necessary information is recorded for compliance and reporting purposes, securely stored and only kept as long as required.

In conclusion, the integration of Recording Insights as part of a comprehensive strategy for RG 271 compliance not only elevates the standards of internal dispute resolution processes but also marks a significant leap towards fostering a customer-centric approach in financial services. By harnessing the power of advanced analytics and recording technologies, financial institutions can not only adhere to regulatory mandates but also enhance the quality of their customer service, thereby building stronger, trust-based relationships with their clients. This forward-thinking approach is essential for the evolution and success of the financial sector in an increasingly digital and customer-focused world.

Recording Insights is a Microsoft Azure based cloud service to record and analyse cloud communication platforms such as Microsoft Teams, Ring Central, and Zoom. It captures all media and uses Azure AI Services and Azure OpenAI to automate compliance analytics and alerting of all recorded data.